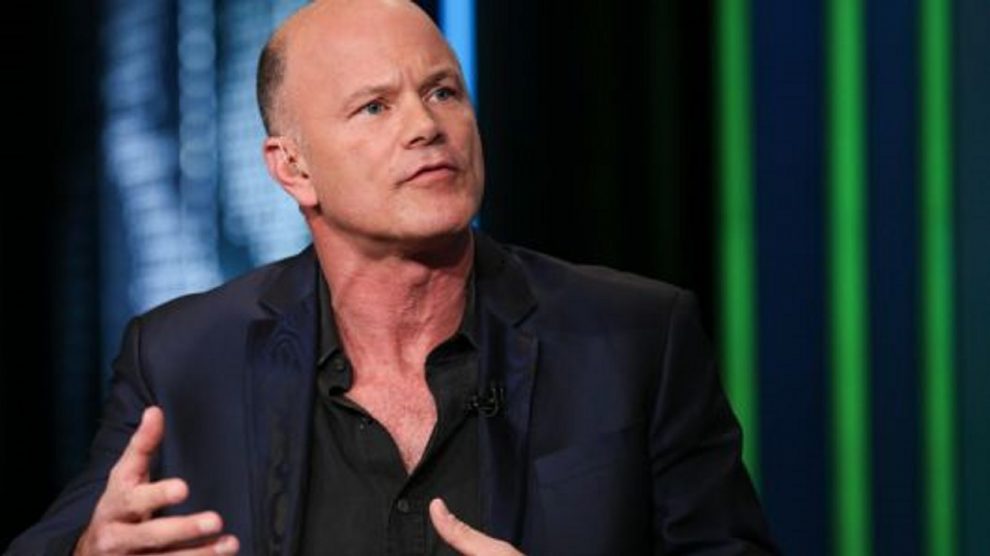

Mike Novogratz, a former partner in Goldman Sachs and hedge fund manager has become well known in the cryptocurrency space. He left Goldman Sachs and set up Galaxy Digital, a diversified merchant bank which caters to the needs of the digital assets and blockchain technology industry. An outspoken proponent of cryptocurrency, Novogratz clarified in an interview with Bloomberg earlier today that he is undeterred by the recent price collapse in the cryptocurrency.

Whilst Novogratz himself had an interest in Bitcoin and cryptocurrency before last year’s price peak, his company Galaxy Digital suffered from less fortunate timing, with funding having been raised for the venture in January 2018 when the market was already beginning to correct.

Galaxy Digital reported a loss of $136 million as per company filings at the end of last month, accounting for the first three quarters of 2018. It appears that much of that loss was accounted for by losing bets on Bitcoin, Ethereum and Ripple. Market conditions have been adverse in a 2018 cryptocurrency bear market for those taking bullish positions.

Company filings indicated that the value of digital assets held at the end of September amounted to $90.6 million with an original asset cost of $172.2 million. From the company filing:

“While we continue to improve and strengthen our trading business, lack of overall trading volume in cryptocurrencies has been a headwind.”

In the interview with Bloomberg, Novogratz clarified that the company did well to hedge the initial losses in cryptocurrency pricing earlier in the year but still got caught further into the year. Novogratz was of the opinion that Bitcoin would hold at $6,200 as it had already done so for 4 months. However, the double blow of a messily contested Bitcoin Cash fork and sanctions applied by the Securities and Exchange Commission (SEC) on companies that it deemed to have not followed securities laws in effecting Initial Coin Offerings (ICO’s) scared investors leading to the more recent price collapse.

When asked about those that treat cryptocurrency almost like a religion, Novogratz said that when prices get stupid, he sells. He explained that when people started asking to take selfies with him on the street, he felt that was weird and that it must be a sign that crypto is close to peaking.

Novogratz view on the ICO market is that it is effectively dead right now. He believes that the SEC had not kept apace with developments in the ICO market and in trying to catch up, its response was harsh. However, as a result of having talked with the commission, he doesn’t feel that it wants to stifle innovation. His belief is that ultimately a security token market will emerge, particularly in industries such as real estate.

When asked if we should think of cryptocurrency as a commodity, Novogratz stated:

“I do believe Bitcoin is going to be digital gold. That means it’s the only one of the coins out there that gets to be a legal pyramid scheme. Just like gold is. All the gold ever mined in the history of the world fits in an Olympic-size swimming pool. You’re out of your mind to think that pools worth $80 trillion. But it is because we say it is.”

In consideration of the market peak, Novogratz believes that there’s a lot of testosterone and greed amidst the speculative mania. The situation has gone past sobriety at this point with pessimism and fear of crypto going to zero.

“It’s not going to zero. We’re at the methadone clinic.”